Menu

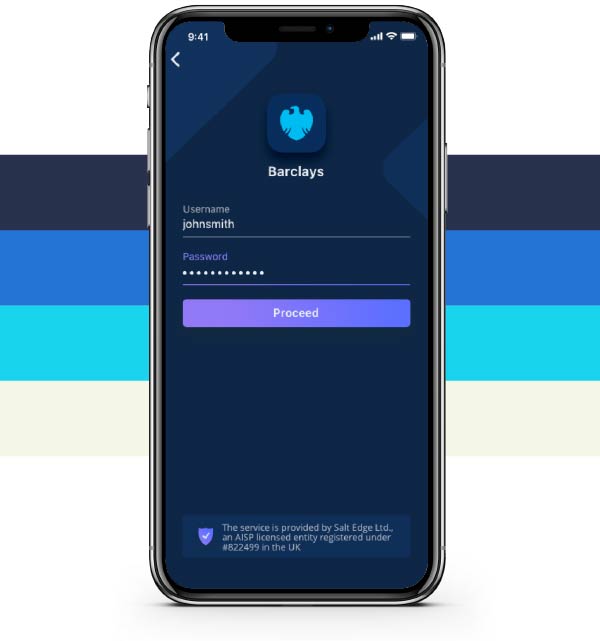

Collaborating with Salt Edge, Pannovate gears up its service offering with the technology that helps its clients in the UK, Europe become compliant with strict PSD2 requirements.

This new offering provides a full end-to-end solution from SCA enabled on-boarding to a secure TPP verification system and open banking channels. As security is paramount in Open Banking, Salt Edge SCA Authenticator protects end-customers during the payment process, thus eliminating fraud risk. The TPP verification system will ensure Pannovate clients that only regulated third parties are able to access the open banking channels built by Salt Edge for them.

“

“

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |