Menu

Collaborating with Salt Edge, Pannovate has geared up its service offering with technology that helps its clients in the UK and Europe become compliant with strict PSD2 requirements.

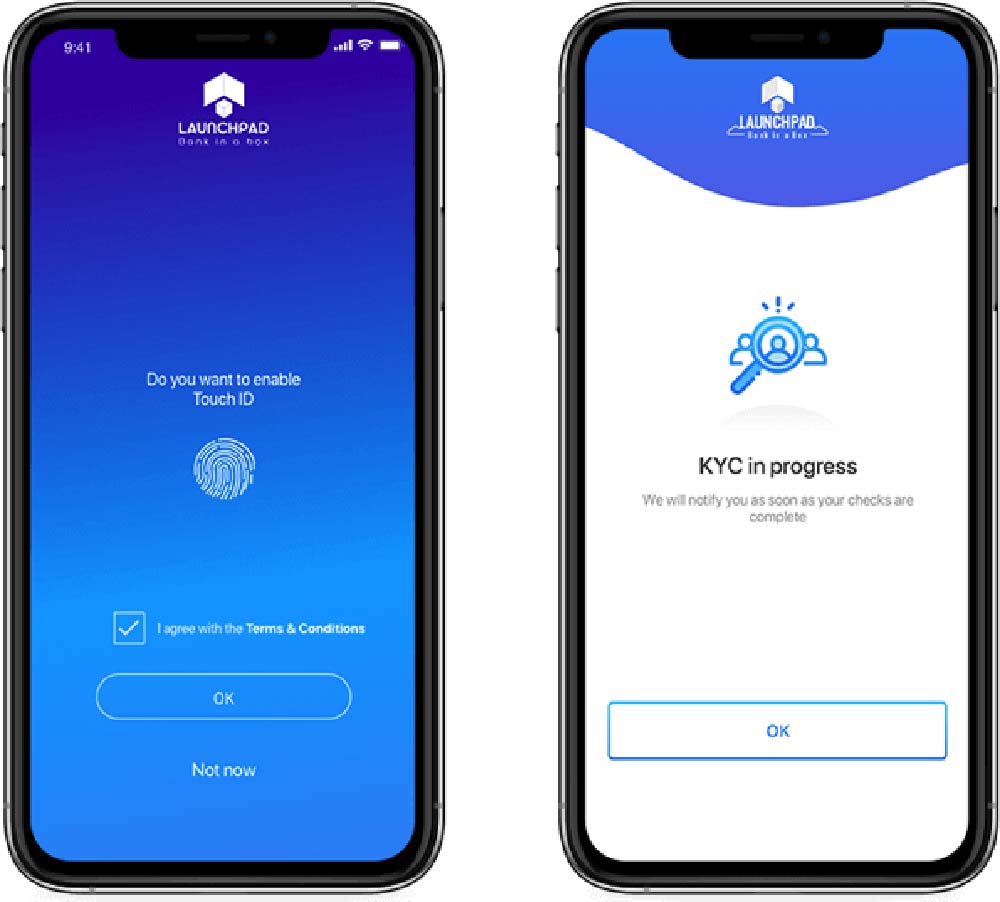

This offering provides a full end-to-end solution from SCA (Secure Customer Authentication) enabled on-boarding to a secure TPP verification system and open banking channels. As security is paramount in Open Banking, Salt Edge SCA Authenticator protects end-customers during the payment process, thus eliminating fraud risk.

The TPP verification system will ensure Pannovate clients that only regulated third parties are able to access the open banking channels built by Salt Edge for them.

“

Open Banking is the UK version of PSD2. The difference is that whilst PSD2 requires banks to open up their data to third parties, Open Banking dictates that they do so in a standard format. This makes it much easier to use, so should allow start-ups and tech divisions to create innovative new products.

This piece of legislation is a significant step towards a single digital market in Europe (cool, but still what’s it got to do with me?) PSD2 is the regulation that all payments service providers must be compliant to operate in the EU. In other words, if you are offering an account for day to day use, then you need to have Open Banking enabled on your product.

It set out common legal framework for businesses and consumers when making and receiving payments within the European Economic Area. Programmes need to enable third party access via secure API’s which Pannovate can provide via our third-party provider.

Click here for the full low down on changes from UK Finance

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |