Menu

We designed Launchpad Corporate differently. Rather than starting with the tech, we started with the user experience. Following swathes of groundwork, Launchpad Corporate was created as an out-of-the-box solution to make 20 parties’ worth of technical integrations work seamlessly with the look and feel to “convert” even the most hyper-critical customer to use your product.

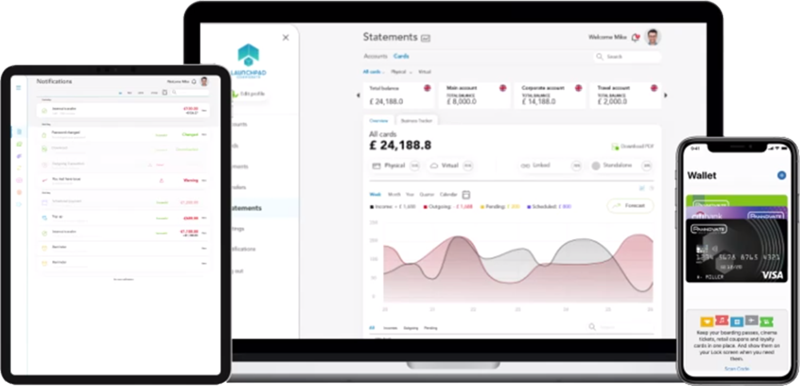

Features include elements such as enhanced statements with real-time notifications, multi-currency cross-border payments and transfers, multi-party pay-out and many more. Our innovative Bolt-On Solutions enable clients to add functionality quickly and cost effectively to create a finance platform that works for them. The modular nature of Launchpad Corporate makes it cost viable and flexible enough to create an attractive and unique banking solution. Other attractive benefits of Launchpad Corporate are its light integration and implementation requirements, meaning less disruption and easy to market delivery.

Our expertise and experience built-in Launchpad Corporate, means you can shape your customer experience with the knowledge that your design will be received as intended and that your users will have access to Launchpad Corporate on their computer (web app), smart phone (mobile app) or tablet (responsive web app). Our system ensures the customer receives the rich experience you intended them to have using intuitive interfaces and native security.

Read more about the Launchpad ecosystem here

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |